April 2024 – Investment Update:

Introduction:

These articles will always contain two main sections:

IDEA GENERATION:

Growth Stock Pick

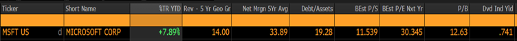

MICROSOFT (Ticker: MSFT US) – Microsoft has been leading disruption in workplace productivity for the last 4 decades. The company’s early strategic partnership with OpenAI highlights their early leadership in the AI space. On their product offering they plan to incorporate generative AI features across their Cloud and Office Productivity services.

“Generative AI refers to a class of artificial intelligence systems that can generate new content or data that resembles, and sometimes even surpasses, what humans create. These systems typically work by learning the patterns and structures present in a given dataset and then using that knowledge to produce new, original content.”

Microsoft recently hired a new CEO of AI, Mustafa Suleyman, a pioneer of the industry, which underscores their intentions. In aggregate, the AI industry is projected to reach $1.3 trillion by 2030 or a 42% CAGR (Compound Annual Growth Rate) over the next 10 years.

Although AI is the new “hot growth trend” the business already has a diversified revenue stream to support its growth ambitions, these are notably:

Microsoft has very healthy liquidity/solvency ratios and maintains highly profitable business margins. While anything can happen when they report earnings this week and as the stock and had an excellent quarter 1, the stock is currently expensive. However, I would recommend adding it to a growth portfolio, if any substantial pullback in price is witnessed or occurs in the near future.

Microsoft last 5 years of Performance:

Dividend Portfolio Stock Pick

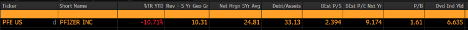

Ticker – PFE US Pfizer over a 6.5% dividend yield.

Pfizer stock suffered a sell off over the last 12 months as demand for their Covid-19 vaccine medications (Comirnaty and Paxlovid) slowed dramatically. Concerns have also been raised about expiring patents on some of Pfizers key product lines. However, this is seen as a temporary impact rather than a long term problem. Pfizer has an excellent track record of innovating and commercializing new products in the past. Some of their most promising pipeline drugs are in the Oncology (Seagen Acquisition) and Duchenne Muscular Dystrophy (DMD) space.

The company’s current strategic plan revolves around paying down debt, reallocating capital and focusing on cancer therapies going forward.

Viking Therapeutics (VKTX) has emerged as a potential acquisition target for larger pharmaceutical companies due to its promising developments in the GLP-1 weight loss market. Pfizer has stood out as a logical buyer given its financial strength, recent focus on acquisitions to replace patent expirations, and interest in the GLP-1 space with its candidate drug, Danuglipron. We are watching this development as a means for a further growth avenue for Pfizer.

While it’s difficult to predict a precise bottom, the current 6.5% yield and Pfizer’s product track record, makes it is an attractive entry point for dividend investors with a long term horizon.

Pfizer last five years of Performance:

Please let me know if you would like further information

Fixed Income:

6% yielding Royal Bank of Canada bonds – This offers quality yield at AA- investment grade credit rating.

Structured Product:

21 Our latest equity linked structured products are yielding 11% per annum. Please inquire for more information.

MARKET OUTLOOK

World Markets:

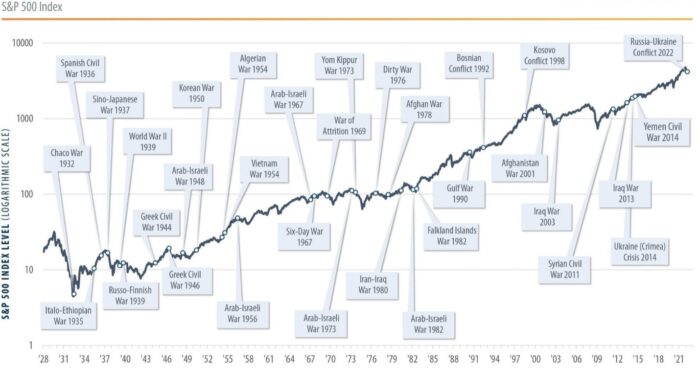

Global markets have been volatile over the last few weeks as an increasingly dangerous environment unfolds in the Middle East. Iran’s drone/missile attack on Israel last weekend, while mainly performative in nature was meant as retaliation for Israel’s strike on one of Iran’s consulate buildings in Syria. Israel continues to accuse Iran of funding the terrorist organization Hamas, in Gaza, and other anti-Israel organizations. G7 members have called for de-escalation and the opening of diplomatic channels. The VIX index (a measure of market volatility) moved to its highest level since Oct 2023 on the news, while global equity markets sold off.

A regional conflict between Israel and Iran would have a much larger effect on global growth, something the US has actively advised Israel against pursuing. Surprisingly oil markets did not react forcefully to the increased tensions, but would certainly spike if further escalation occurs.

At the time of writing U.S. officials report they expect a strike from Israel to be of a limited scope. The U.S. has warned Israel that it won’t be part of any escalation with Iran.

As a reminder war outbreaks are usually a buying opportunity and market usually recovers quickly from an initial drawdown (see below). We are also happy to discuss what these events mean to investor portfolios on a personal basis.

Impact on S&P 500 of Global War

North America:

There are three themes, besides geopolitical conflict, impacting US markets at present:

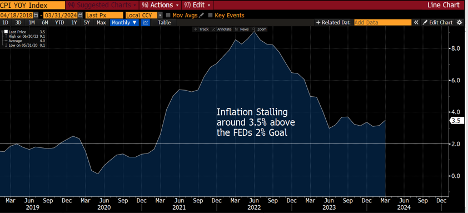

We have had three strong US CPI prints to start the year. It is becoming clear that the 2023 trajectory of slowing inflation is stalling around the 3.5% mark. The FEDs goal of reaching 2% inflation is being pushed out. The disflation (slowing inflation) narrative of 2023 was excellent news for markets as it meant FED interest rates were likely to fall soon with Fed Chair, Jerome Powell, even making this case in late 2023. However, sticky components of service inflation in shelter and auto-insurance, among others, are making the battle difficult. The markets pricing of rate cuts has fallen from 6/7 cuts at the start of the 2024 year to 1/2 cut today. This repricing especially after the third CPI release of the year has caused equity markets to pull back from all-time highs.

Headline US CPI (Consumer Price Index) YoY

We still expect the fundamental path of inflation to remain downward as the lagging impact of measurement in certain areas of the CPI calculation start to flow into official numbers, although the time horizon is slower than originally anticipated.

Base Case Fixed Income Outlook

Bond yields are likely to stay higher for longer in 2024 as a result of the inflation dynamic. While this offers a good time to lock in duration for many of our income investors, equity markets may see further volatility until the inflation narrative improves.

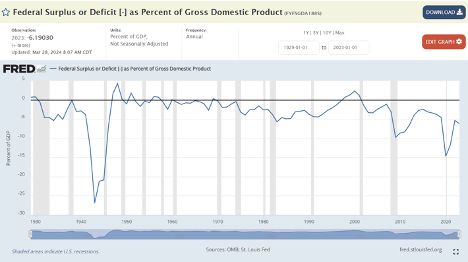

2. Fiscal deficits and GDP:

Why has disflation stalled? One reason is government spending. When the government doesn’t have enough revenue it issues bonds. The spending of these government funds in the economy increases demand for goods/services leading to higher inflation (demand-pull inflation or secondarily increase of the money supply). While fiscal deficits are a normal occurrence in government financing, extreme levels can have detrimental effects. Fiscal deficits are currently 6% of US GDP. This level has not been seen since the US was in World War II (outside of covid-19), and it likely to having an impact on sticky inflation (prices staying unnecessarily high).

Federal Deficit as a percentage of GDP

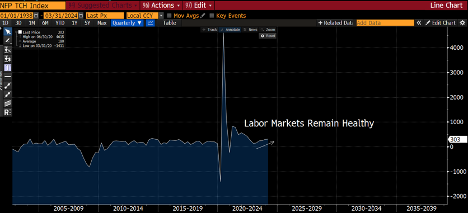

3. Strong labor markets and retail sales

The significant level of government spending can contribute to job creation, provide stimulus to economy aiding consumer spending, while simultaneously boosting economy output/growth. Monthly labor figures still highlight a robust labor market, albeit cooling from the extreme tightness during the pandemic. Retail sales point to strong consumers, as do the major banks (JP Morgan, Bank of America, Wells Fargo who reported this week) all saying consumer deposit balances remain healthy. Despite the headline figures there are issues under the surface within labor markets that indicate the market is not as strong as initial glance. Some examples are the decline in full time jobs, previous downward revisions and strength of government jobs.

Non-Farm Payrolls – Measure of New Job Creation

Retail Sales

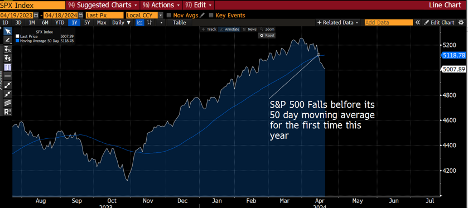

Base Case Equity Outlook

Our base case remains that interest rates will stay elevated for now, but the downward inflation trajectory will continue, albeit at a slow(er) pace and labor markets will weaken further, providing evidence that a cut or two from the FED are needed before the year end.

It was a blistering start to the year for US equity markets with the S&P 500 posting an excellent quarter up 10.06%. We expect some consolidation (a breather) in the short term, as the market recalibrates for a stickier inflation environment as well as growing Middle East uncertainty. Despite the negative global themes, Quarter 1 earnings out over the next few weeks are expected to be robust and a tailwind to equity performance. We will watch with interest but given the macro uncertainties and technical outperformance in quarter 1, we will wait to assess this earnings quarter before making any major additions.

Asian Markets:

China posted a solid quarter 1 of 2024 of 5.3% annualized GDP, with speculation building the country has bottomed from its worse stock market drawdown since 2009. However more forward looking indicators in industrial output and retail sales point to a continued challenging environment. Not to mention China’s last CPI/PPI readings pointed to a deeper slide into deflation, reflecting weak domestic demand and excess capacity in certain industries. There are pockets of strengths in manufacturing and government focused industries such as new energy vehicles and integrated circuits, however there is uncertainty over consumer spending and stabilizing their property market.

We await China’s upcoming Politburo meeting where economic policies will be set before deciding whether Chinese markets are attractive. This may be a catalyst for a more supportive investment environment. While a date has not yet been set it (raising concerns among investors), it usually occurs in late April.

Other Markets:

If you would like to discuss any topics as our client or prospective client, please do reach out to us.

Author: Robert Whelan

[1] https://www.bloomberg.com/company/press/generative-ai-to-become-a-1-3-trillion-market-by-2032-research-finds/